The Working Number Compendium

“It’s the biggest privacy breach in our time, and it’s legal and no one knows it’s going on,” said Robert Mather, who runs an employment background company named Pre-Employ.com. “It’s like a secret CIA.”

Everything you need to know about The Work Number

- What It Is and Why you Should Care

- How to Request your Free Copy, and Freeze it

- How to Manage Recruiters

Over the last 18 months, we have seen the rise of services to help recruiters catch interviewers lying, spy on their previous compensation, and list out their previous employment history. Since we are committed to encouraging job seekers to embrace their own self-interest, we have compiled this compendium detailing everything you need to know about TWN and related services.

This is a “living document” which will be constantly updated as the TWN service changes, so make sure to bookmark this, sign-up for our newsletter, and check back for updates.

Table of Contents

What is ‘The Work Number’?

TWN is not just for people lying on their on resume, but if you are concerned about an upcoming employment verification check, you have options.

The Work Number is an online database that stores employment and income records. Although it has been around since the 80’s, it has only just recently gotten popular as a screening or verification tool for recruiters. The information is to debt collectors, financial service companies and other entities. Despite the fact that we commonly share information on social media, etc. the one piece of information that is held sacred is our compensation. The Work Number sells that history to whomever wants to buy.

“It’s the biggest privacy breach in our time, and it’s legal and no one knows it’s going on,” said Robert Mather, who runs an employment background company named Pre-Employ.com. “It’s like a secret CIA.”

Salary information is not the only information for sale by The Work Number. Its database is detailed enough to include week-by-week paystub information (dating back years for many individuals), business income (we believe they are purchasing data from Quickbooks), as well as other kinds of human resources-related information, such as health care provider, whether someone has dental insurance, and if you’ve ever filed an unemployment claim. In 2009, Equifax said the data covered 30 percent of the U.S. working population – we believe that number to now be closer to 50-60%, and The Work Number claims to be adding 12 million records annually.

History of ‘The Work Number’

Origins in the Late 1980s to 2000s

The origins of The Work Number date back to the late 1980s when the profit potential associated with manual employment verification processes. At that time, employers, lenders, landlords, and government agencies relied on more “personal” methods to verify employment and income information, such as direct contact with employers’ human resources departments or requiring pay stubs.

The Work Number was officially launched in 1985 as an automated employment and income verification service. Initially, the service targeted large employers who could benefit the most from reducing the workload associated with manual verifications.

Throughout the 1990s, The Work Number expanded its reach by incorporating more employers and refining its technology. The service leveraged advancements in database management and telecommunications to improve the speed and reliability of verifications. This period also saw the establishment of partnerships with various industries, including finance, housing, and government, which further integrated The Work Number into critical verification processes.

In reality, given that TWN was still an offline process, it did not catch-on since it was no easier than just calling an employer and asking for the same information.

Growth and Technological Advancements in the 2000s

The 2000s marked a significant period of growth and technological enhancement for The Work Number. As the internet became more widely accessible, The Work Number transitioned to an online platform, making it even more convenient for verifiers to access employment and income data. This shift not only increased the speed of verifications but also enhanced security measures to protect sensitive information.

During this decade, The Work Number also expanded its services to include much more detailed and comprehensive data – and became a lot more dangerous for employees. This included not just basic employment information but also detailed income records, which were crucial for lenders and other financial institutions. It was still considered a novelty service during this time, and seldomly used.

The Work Number, which was part of an independent St.Louis-based firm named TALX, was acquired by Equifax in 2007 for $1.4 billion.

Modern Era: Integration and Ubiquity

In the 2010s and beyond, The Work Number continued to evolve with the integration of artificial intelligence and machine learning. These technologies further improved the scope of data that could be synthesized, compiled, and sold to recruiters.

Today, The Work Number is used by millions of employers, employees, and verifiers. Its extensive database covers a wide range of industries, making it a comprehensive resource for employment and income verification.

Why Job Seekers Must Be Aware

TWN is not just for people lying on their on resume, but if you are concerned about an upcoming employment verification check, you have options.

Even if you are not lying on your resume or during the interview (a practice that we fully embrace), all job seekers must stay abreast of what TWN and related services can do to their career. The information will typically be used during a job verification, but has started to be used by recruiters during the interview process itself. It can also be pulled and referred to at will, since most contracts are flat-fee (HR does not pay to pull information at will on any of their employees). This means that even after you start your job, the TWN report can still be used against you. The justification for at-will pulls, is that companies want to catch employees who are overemployed.

But the real problem, is that at times, job seekers have complained about errors in the data.

Where Does the TWN Data Come From?

TWN is not just for people lying on their on resume, but if you are concerned about an upcoming employment verification check, you have options.

A TWN report is quite comprehensive, and includes information on a job seeker’s employment dates, salary history, paystub information, health care provider, whether someone has dental insurance, and if they’ve ever filed an unemployment claim. It also now shows business income, which we suspect is being sold by QuickBooks. Previously, procuring this data was illegal, but Equifax found a work-around to the system.

How does Equifax obtain this sensitive information? With the willing aid of thousands of U.S. businesses, including much of the Fortune 500. Government agencies (as much as 80-85% of the federal civilian workforce) use the service, including schools and healthcare workers. In order to access the data, these organizations also allow a quid pro quo – they allow Equifax to tap directly into their HR systems so the credit bureau can sell the information to others. In other words, these organizations actually pay Equifax for the privilege of giving away their employees’ personal information.

Equifax also sells this data to third parties, including debt collectors and other financial services companies.

“The story here is how (The Work Number) is getting this information,” he said. “When people find out, no respectable employer will continue to do this.” Robert Mather, who runs a small employment background company named Pre-Employ.com

Why do Companies Provide Our Data?

TWN is not just for people lying on their on resume, but if you are concerned about an upcoming employment verification check, you have options.

Companies sign up for The Work Number because it gives them an easy way to outsource employment verification of former workers.

Firms hate taking these calls, which usually come when a former employee is applying for a new job, because they are a costly distraction for human resources departments and open the firm up to lawsuits if someone says something disparaging about the former employee. So they contract with The Work Number, which automates the process. In exchange, firms upload their human resources data to The Work Number, which was part of an independent St.Louis-based firm named TALX until it was acquired by Equifax in 2007 for $1.4 billion.

Requesting A Free Copy

TWN is not just for people lying on their on resume, but if you are concerned about an upcoming employment verification check, you have options.

Because the data is considered a credit report, consumers are entitled to one free report every year. The report shows what data the report contains, and what entities have seen it.

Step 1: Sign up for access

*If your employer is not listed we suggest calling the Client Service number to request a copy of your data report here.

Step 2: View your data report

Once you have signed up for access you can use the portal to view your data report. See it on this link

*If your employer is not listed we suggest calling the Client Service number to request a copy of your data report.

Step 3: Request a copy of your data report

The easiest way to get a copy of your data report is to call the Client Service number to request a copy of your data report be sent to you via secure email or US Mail.

Dispute your data report

Have you viewed your data report and noticed an error? You can open a dispute online with the link or via phone, Client Service Center, 866-222-5880, Option #2.

Freezing your TWN Report

TWN is not just for people lying on their on resume, but if you are concerned about an upcoming employment verification check, you have options.

Everyone should freeze their TWN – no matter what situation you are in, it simply does not benefit you to have this active.

First of all, if you are overemployed – this is the way a lot of overemployed (OE) workers get caught. You should keep your reports frozen during the interview process, and throughout your employment with that firm. You never know when someone might have a reason to pull your report, and The Work Number is beginning to be marketed as a way to catch people working multiple jobs.

Secondly, the information can be used against you by debt collectors, banks, loan officers, and potential business partners. Again, Equifax includes this in their positioning and marketing of the product, and they are pushing to grow in this space over the next few years.

Not worried because you haven’t lied about anything ever? The problem is that the information on TWN is notoriously inaccurate, so you might still get punished for something in the report. And having your salary information hurts you in potential negotiations, since they can see exactly how much you think you are worth.

Are there any negative consequences to having your TWN frozen?

In some cases, consumers have reported new bank account opens being delayed due to a TWN freeze. However, these consumers have confirmed they were still able to open it (it simply delayed the opening).

During a background check the verifier will know that it is frozen. We walk you through how to handle this in our Excuses section.

Otherwise, there is no negative impact on freezing your information.

Step-by-step directions on how to Freeze your TWN

The official data its in this link, but here we have it summarized for you:

By Phone

Call The Work Number Client Service Center, 866-222-5880

When calling there is no option to ‘Freeze your TWN’ so you’ll have to navigate around and find a representative. Choose Option 2, “Report an error in your TWN Report”. And then choose to “Speak to a representative”.

They will ask the spelling of your first and last name, current employer code – yours may not show up in the system in that case the representative may place you on a brief hold and do additional research.

If they are still unable to verify your identity with your “current employer” or “past employer” numbers, then they will give you the option to verify your identity via US Mail or by email. You will be sent an encrypted email with a link to a Virtru secure reader.

You then upload your proof of identity and proof of address documents. The types they accept are below:

Proof of Identity:

- Provide a copy of one of the following (must include current/legal name):

- Driver’s License (must be current)

- State or Government Identification Card

- Social Security Card

- Military Identification Card

- Passport (must be issued from U.S.A. and be current)

- W-2 or 1099Form (most current year)

Proof of Address:

- Provide a copy of one of the following (must include current mailing address and be issued within the past 60 days)

- Utility Bill (phone, water, gas, electric, trash or sewer, etc.)

- Paystub

- Housing Rental Agreement (must include signature page) or Mortgage document inyour name

- W-2 or 1099 Form (most current year)

Freeze – 3 business days from the date of the call – Please note the US mail option may take up to 6 weeks.

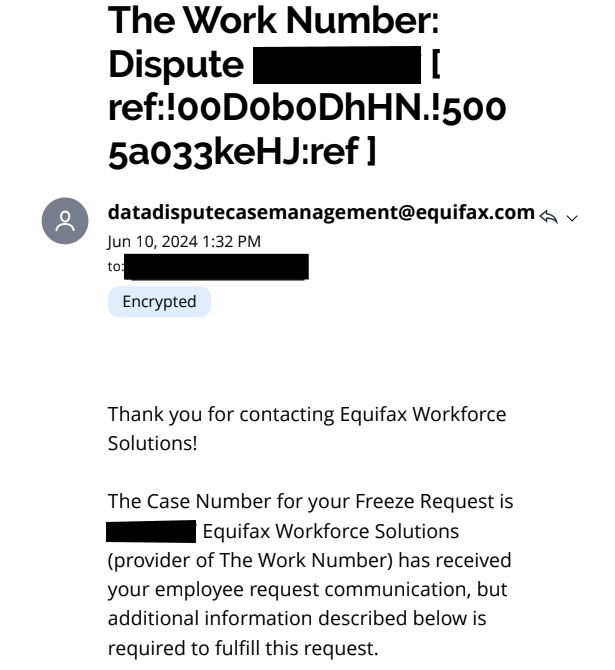

By eMail

To freeze your TWN by email, simply email TWNFreeze@equifax.com and they will start a secure email with you to verify your identity first and then initiate your freeze. Once they have received the requested documents to verify your identity, your data will be frozen within 3 business days.

By Mail

Send this form by mail to the address listed below:

Equifax Workforce Solutions

ATTN: Employment Data Freeze

3470 Rider Trail South

Earth City, MO 63045

Complications??

Requested a report and there is no current employer listed.

You’ll also want to prepare yourself for the background verification check, if you’ve decided to lie on your resume. We provide services to help with this, if needed.

Excuses Why your TWN is Frozen

TWN is not just for people lying on their on resume, but if you are concerned about an upcoming employment verification check, you have options.

Once your TWN is frozen, if a background check provider (e.g. HireRight) is using it as a reference, they will often come to you, asking about it being frozen.

There are a number of excuses you can provide, but only one that we recommend. When you read these, keep in mind that your goal during the background check is to remain as “boring” and under-the-radar as possible. You don’t want anything interesting to happen, you want the entire experience to be forgettable for your verifier. Every single time you cause them some concern, or make up an excuse that sounds strange, you work against yourself, especially if you are lying or are planning on working overemployed.

Excuse #1 – Acting Dumb

“Huh? What’s a Work Number?”

This is the excuse that we recommend you use – because it is the most reasonable response by someone that is not lying.

Think about the time you first learned about the Work Number. You were most likely researching ways to do overemployment or fabricating something on your resume. By and large, the TWN remains a mystery for most of the job-seeking population, and it is actually unusual for you to know about TWN to begin with. So if you are lying, and froze your TWN, why not simply act like someone that has never heard of TWN to begin with?

And then, if the recruiter explains it you, sound interested. “Really, they have reports that can pull that information? I had absolutely no idea.”

And if the recruiter asks you to unfreeze it: “I wouldn’t even know where to begin. Isn’t this something you have to do on your end?”

99/100 times, the verifier is just going to give up and move on… or even more likelier, they will blame it on a reporting error on their end, since you clearly did not freeze it.

And if for some reason they insist on you unfreezing your account, tell them, “Absolutely! I’ll get right on it!”. Then wait two days, and tell them, “I’m sorry, I tried, I spent an hour on the phone and no one would help me. The website provided does not allow me to login. I have no idea how to do this.” This is actually a very believable lie, because their customer service is absolutely terrible on the employee side (they have fantastic customer service for recruiters though).

Remember, the TWN is only one method they have at their disposal to verify your background, so they’ll just use those methods and skip the TWN.

Excuse #2 – Right to Privacy

“I am concerned about identity theft and have blocked the release of all my personal information.”

This one has worked for people, and on the surface, it sounds reasonable. But the problem is, in the recruiter’s mind, they think that TWN is a completely innocent service (they wouldn’t use it otherwise). Read the marketing materials from Equifax – they paint this as a clear win-win for the employer and the job candidate.

So if TWN is a great service for the job candidate, why would you be concerned about your privacy?

It’s just a psychology question there. If they like you enough, they just accept it and move on. But it does sound strange, and a recruiter will naturally think that the reason you froze it is because you are lying. You can give excuses that are reasonable, but recruiters are unreasonable people, and they could exploit any red flag you give them.

Excuse #3 – “I have a Stalker”

This has been used in a few cases, and it seems to always come off as contrived and suspicious. While there are probably real-life cases where this is true, recruiters are going to instantly start asking questions about this. Are you comfortable telling a complete fable about this? Or just telling them, “It’s private” as though that isn’t going to sound even more suspicious?

I would not recommend using this excuse.

Excuse #4 – Victim of Identity Theft

“I was the victim of identity theft and have blocked all personal information upon the advice of your attorney”.

This is a reasonable excuse, and a lot of recruiters will understand. It has reportedly worked for people in the over-employed community. However, it will still raise an eyebrow.

They might still ask you to unfreeze it. In that case, you might respond as follows:

“I keep my credit report frozen as a standard practice. I only unfreeze it as-needed, such as when making a purchase.

I’ve not yet had an employer request I unfreeze it for a background check. I would consider consenting to a short availability window if non-negotiable, however I would actively push back due to privacy concerns.”

Any Questions?

Write down your questions about ‘The Working Number’.

Share your own advice, or subscribe to our newsletter for career insights.